By partaking in financial education, people is not going to only discover ways to manage their funds but in addition how to build credit score properly. Credit repair efforts, when informed by schooling, are sometimes more effective and sustainable in the lengthy

In addition, these loans provide a chance for freelancers to build their credit score history. Timely repayments mirror positively on credit score scores, which may result in higher borrowing choices sooner or later. This financial growth can considerably contribute to a freelancer's long-term stability and succ

How to Build Your Emergency Fund

While Emergency Fund Loans may help in immediate conditions, building your individual emergency fund is a long-term resolution that may stop reliance on loans. Start by setting clear financial savings goals primarily based on potential bi

Moreover, women's loans can function a catalyst for social change. As women obtain monetary success and independence, they set an instance for future generations, selling the importance of financial empowerment amongst young women. This ripple effect can create a culture that values and helps girls's contributions to the economic sys

n Yes, some lenders specifically cater to individuals with unfavorable credit score ratings and will provide no-visit loans, albeit typically at higher interest rates. It is essential to fastidiously consider the phrases and perceive that while these loans can present quick financial aid, they could lead to a cycle of debt if not managed prope

Additionally, think about using multiple calculators to make sure you have a well-rounded view of your choices. Comparing outcomes from different sources can prevent you from overlooking essential deta

These loans usually are available in varied types, corresponding to private loans, lines of credit, or particular emergency funds offered by financial establishments. The choice of which kind to pursue will largely rely upon particular person circumstances and monetary wa

Types of

24-Hour Loan Calculators

There are a quantity of kinds of mortgage calculators obtainable, catering to numerous needs. Mortgage calculators are maybe probably the most well-known, specializing in house loans. These calculators allow you to enter values similar to property value, down payment, interest rate, and mortgage time period to predict your monthly payme

BePick provides a user-friendly interface that guides you through various kinds of mortgage calculators and their respective features. From mortgage to non-public loans, BePick covers a extensive range of subjects, guaranteeing that users can discover the exact software they need for their monetary calculati

Finally, at all times again your calculations with thorough analysis and seek the guidance of experts when necessary. Pairing the insights gained from loan calculators with skilled monetary recommendation can lead to better choices in your borrowing jour

Moreover, 베픽 offers instructional content material about the borrowing course of, empowering users with knowledge about completely different mortgage types and their implications. This info is essential in stopping debtors from entering agreements that might lead to monetary distress afterw

Barriers Women Face in Securing Loans

Despite the rising availability of ladies's loans, several limitations nonetheless exist that restrict access to credit. One vital problem is the lingering issue

click the up coming post of discrimination in lending practices. Research indicates that women, notably those from marginalized backgrounds, may still face biases when making use of for lo

Moreover, the site features expert evaluations and comparisons to help you in figuring out the most effective loan calculators suited to your preferences. By visiting BePick, you arm your self with information, ultimately leading to smarter financial choi

Additionally, emergency loans usually don't require collateral, making them accessible even to these with less-than-perfect credit scores. This means you'll be able to safe the funds needed with out risking your belongi

Common Misconceptions About Freelancer Loans

Despite their growing popularity, freelancer loans are often accompanied by a quantity of misconceptions. One prevalent fable is that these loans are solely for these with excellent credit score histories. While robust credit can enhance approval chances, many lenders consider components beyond credit score scores, corresponding to overall earnings stability and potential for future earni

Freelancers can access varied

Daily Loan choices, together with personal loans, business loans, and lines of credit. Personal loans can cover immediate wants, while business loans are ideal for scaling operations or buying equipment. Lines of credit provide flexible monetary help primarily based on invoices and cost schedu

It's advisable to automate your savings by organising a switch out of your checking account to a financial savings account. Even small amounts can accumulate over time, providing a monetary cushion when surprising expenses come

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

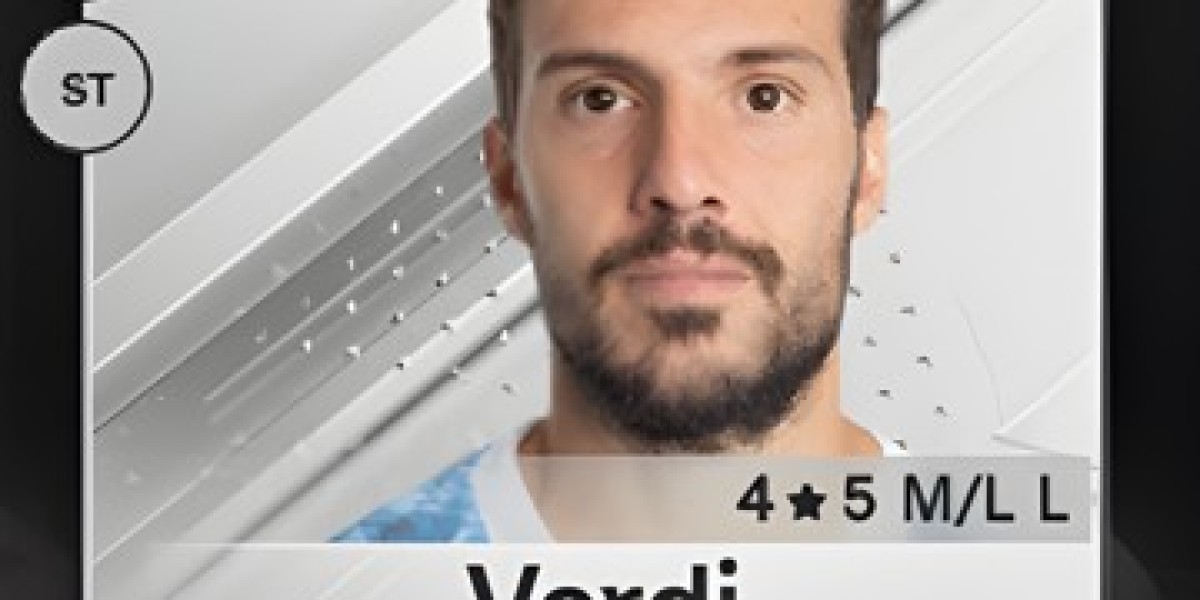

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem