How BePick Can Help

BePick is a complete resource specializing in actual property loans.

How BePick Can Help

BePick is a complete resource specializing in actual property loans. The website provides an intensive assortment of information on varied loan types, present market tendencies, and in-depth reviews of lenders. This platform is designed to empower consumers with the data essential to make informed selections relating to their financing choi

Improving your credit score score is one of the best ways to boost your possibilities of obtaining an unsecured mortgage. Paying down existing money owed, making timely payments, and checking your credit score report for errors might help. Additionally, sustaining a secure earnings and showing consistent employment historical past could make lenders more confident in your capacity to repay the mortg

Additionally, some lenders might impose strict eligibility necessities, making it challenging for individuals with decrease credit scores to qualify for the most effective rates or phrases. This may leave debtors with restricted options and potential monetary str

While securing a enterprise mortgage with poor credit score is difficult, it’s not impossible. Alternative lenders, similar to peer-to-peer platforms or microlenders, may provide choices with extra lenient standards, usually at larger interest rates. Exploring all avenues is import

Disadvantages of Unsecured Loans

Despite their advantages, unsecured loans come with a number of drawbacks. The most notable is the upper interest rates compared to secured loans. Since lenders face more danger with out collateral, they usually cost larger charges to compens

Qualifying for a business loan sometimes involves presenting a strong marketing strategy, demonstrating money move, and maintaining an excellent credit rating. Lenders assess your corporation history and financial well being to gauge your reimbursement capabil

n The major distinction between secured and unsecured loans is that secured loans require collateral, such as a house or automobile, whereas unsecured loans don't. This implies that unsecured loans are riskier for lenders and usually come with higher interest rates. Borrowers with good credit score have a greater chance of getting accredited for unsecured loans, whereas secured loans usually have less stringent acceptance standa

Researching and choosing a reputable service is paramount. Reading evaluations and testimonials may help individuals make informed decisions about which providers to make use of. This due diligence can finally save time and money in the restoration course

Creating a Recovery Plan

The cornerstone of bankruptcy restoration is a well-thought-out restoration plan. This plan ought to determine both short-term and long-term financial goals, including how to handle present debts and rebuild one’s credit profile. Key elements of a restoration plan often embrace adhering to a strict finances, establishing an emergency fund, and presumably in search of professional financial recommendat

Furthermore, Daily Loans can help debtors to improve their credit score scores if managed responsibly. Timely repayments reveal monetary self-discipline, which might positively impact one's credit score history and score over time. This potential to boost creditworthiness is an important consideration for those seeking to rebuild their monetary popular

Another error is underestimating the total costs concerned in securing a

Same Day Loan. Borrowers usually focus solely on the principal and curiosity however overlook further prices similar to closing charges, insurance, and property ta

How to Apply for an Unsecured Loan

The utility process for an unsecured

Pawnshop Loan sometimes entails a number of key steps. First, debtors ought to assess their monetary situation to determine how a lot they should borrow and if they'll afford the repayme

By offering up-to-date info and sensible insights, BePick goals to be your go-to source for all things associated to actual estate loans. Ensuring that your investment decisions are primarily based on reliable knowledge is crucial in today’s mar

The utility process for unsecured loans is mostly straightforward, requiring personal and monetary info, along with proof of income. Once accredited, the funds are often disbursed rapidly, making unsecured loans an interesting possibility for these in want of instant cash f

Monitoring your credit report regularly is equally necessary. By checking for inaccuracies and disputing any discrepancies, individuals can make sure that their credit score reflects their real financial conduct. There are several resources that provide free credit report entry, permitting you to stay infor

Moreover, in the event of missed funds, debtors face extreme penalties. Unlike secured loans, the place the lender can seize collateral, unsecured debt can result in damaging credit score drops and even authorized motion. Therefore, it's

Personal Money Loan essential for debtors to assess their capability to repay before committing to an unsecured mortg

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

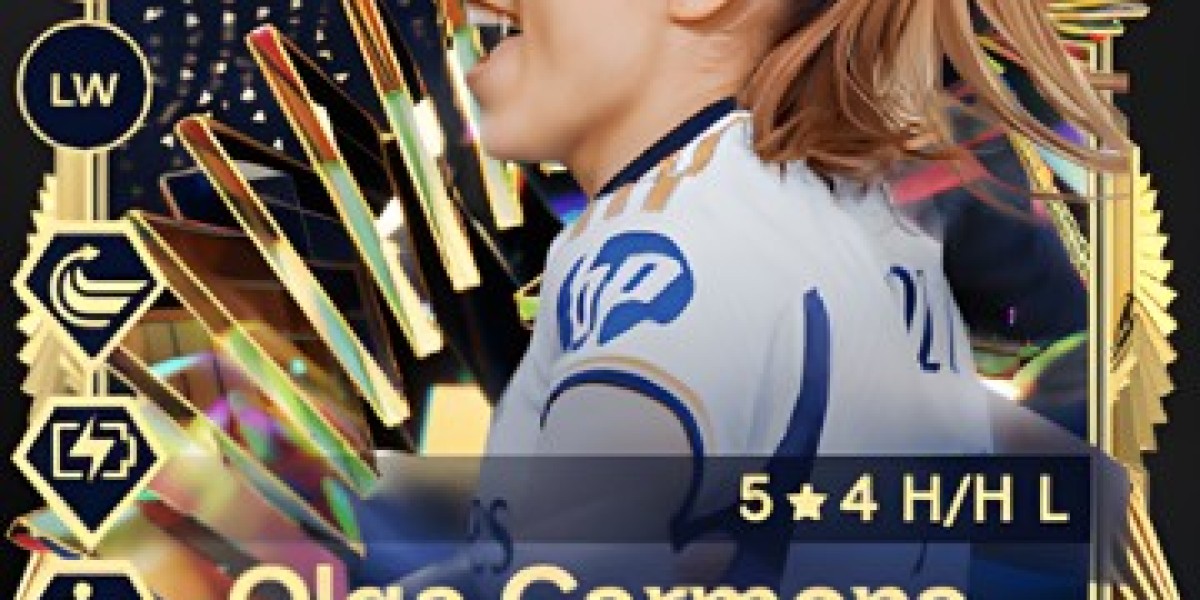

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem