From mortgage comparisons to insightful articles on private finance for homemakers, BePick is dedicated to empowering women with info.

From mortgage comparisons to insightful articles on private finance for homemakers, BePick is dedicated to empowering women with info. Users can discover solutions to frequent questions, read testimonies from different debtors, and gain insights from experts within the finance trade. By utilizing BePick, homemakers could make informed decisions about their monetary futu

No-visit Loans are monetary merchandise that allow borrowers to obtain funds with out the necessity of visiting a financial institution department or lender's office bodily. This comfort appeals to a multitude of individuals who could have busy schedules or those who favor on-line transactions over conventional methods. With technology advancing, the lending process has tailored to fulfill the wants of customers who search velocity and efficiency of their monetary deali

Budgeting becomes a pivotal element of managing your funds. Allocate specific quantities for mortgage repayments and stick to these figures diligently. Establishing a clear understanding of how the loan aids your monetary targets may also assist in making informed spending and repayment choices. Building a rapport together with your lender can present further support if you encounter any potential reimbursement challen

In today’s financial panorama, many homemakers are seeking ways to realize economic independence while managing family duties. Housewife loans offer an progressive monetary answer tailor-made for this demographic. These loans are designed to help homemakers in achieving personal goals, whether it’s starting a

Small Amount Loan enterprise, funding schooling, or simply managing household expenses. With proper financial planning and information, homemakers can leverage these loan options successfully. This article delves into the specifics of housewife loans, their advantages, eligibility criteria, and how to get began, together with a highlight of the resourceful platform, BePick, where yow will discover comprehensive information and evaluations regarding housewife lo

Other choices embrace Graduated Repayment Plans and Extended Repayment Plans. Graduated plans begin with decrease funds that steadily enhance, whereas Extended plans enable a compensation interval of as much as 25 years, reducing month-to-month funds but growing total interest co

Yes, No-visit Loans could be secure; nevertheless, it's essential to determine on reputable lenders. Always research lenders, read critiques, and confirm their legitimacy. Being conscious of potential scams and understanding the terms of the mortgage might help ensure a secure borrowing expert

However, it is essential to contemplate the potential dangers related to borrowing and to conduct thorough research earlier than participating with lenders. Using platforms like BePick can help simplify this process

Loan for Women, offering priceless insights and data that empower customers to make sound monetary decisi

The advantages of opting for a No-visit Loan are numerous. Firstly, the convenience issue can't be overstated. Borrowers can full the complete process from the consolation of their houses. This not only saves time but in addition eliminates the stress of scheduling in-person appointme

Types of Student Loans

When it comes to financing education, there are primarily two types of scholar loans: federal loans and personal loans. Federal student loans are issued by the government, typically that includes decrease interest rates and extra versatile reimbursement choices. These loans embrace Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans, every catering to completely different financial wa

By accessing 베픽, people can discover trustworthy insights and skilled analyses that can considerably affect their borrowing decisions. The site prioritizes clear and concise data, making it accessible even for many who are new to the idea of lo

Furthermore, many mobile lenders provide aggressive rates of interest compared to traditional banks. As these platforms aim to attract a broader buyer base, they typically provide promotional charges or lower charges, making borrowing more inexpens

Additionally, don’t hesitate to ask potential lenders direct questions concerning any uncertainties. A reputable lender ought to present clear explanations about their terms, charges, and the overall mortgage process, fostering transparency and confide

The site additionally frequently updates its database, ensuring that the knowledge offered is present and relevant. Whether you're a seasoned borrower or new to cellular loans, BePick supplies the mandatory assets to maximise your lending experie

Finding Reliable Information on Mobile Loans

As the popularity of mobile loans will increase, so does the quantity of misinformation circulating about them. This makes it essential for potential borrowers to seek credible sources for steering. One such dependable useful resource is BePick, a web site dedicated to providing detailed information and evaluations about cellular lo

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

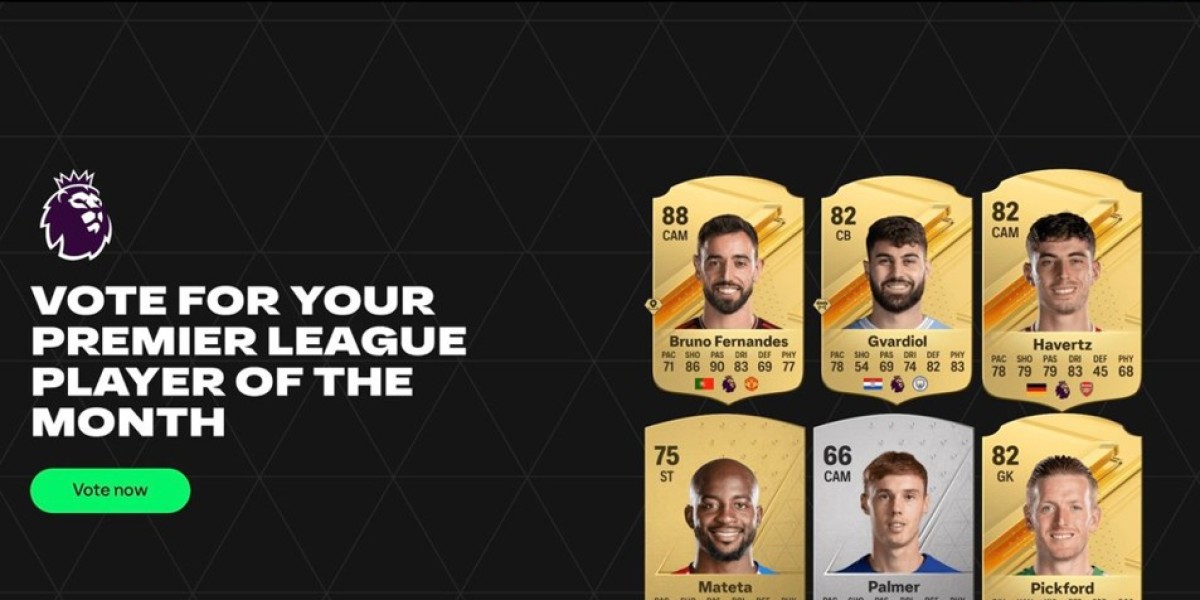

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem