Moreover, there is a rising prevalence of fraudulent lenders operating on-line. Many opportunistic scammers pose as legitimate lenders, seeking to take advantage of susceptible debtors. It is important for consumers to thoroughly analysis lenders, examine critiques, and search for credible certifications earlier than proceeding with any mortgage applicat

It is advisable for potential borrowers to evaluate their financial standing and collect all needed documentation earlier than applying. Understanding the eligibility necessities can save time and disappointment in the course of the mortgage utility course

Resources at BEPIC for Low-Credit Loans

BEPIC is a complete platform that provides useful assets for individuals exploring low-credit loan choices. The web site options an array of knowledge, together with detailed critiques of various lenders, comparisons of mortgage types, and academic articles aimed toward bettering monetary liter

The website's comprehensive guides and professional critiques be certain that potential debtors have entry to trustworthy information, permitting them to weigh choices successfully. Whether you're a first-time homebuyer or an experienced investor, BePick can enhance your understanding and confidence in managing real estate lo

Furthermore, mobile loans supply aggressive curiosity rates and flexible repayment options, allowing debtors to discover a plan that matches their monetary state of affairs. This flexibility is especially useful for those experiencing temporary money circulate issues, because it provides them with a lifeline until they're back on their ft financia

On BePick, users can find complete guides on various mortgage varieties, tips for improving credit scores, and insights on current Loan for Day Laborers market tendencies. This platform serves as a valuable software for those exploring real property financ

Unsecured loans also provide flexibility by method of usage. Borrowers might use the funds for quite lots of functions, similar to house enhancements, medical expenses, or travel, depending on their individual ne

Exploring BePick for Real Estate Loans

BePick is an invaluable useful resource for anybody navigating the complex world of real estate loans. It provides detailed data and user-friendly critiques that help demystify the mortgage process. By offering insights into totally different mortgage varieties, eligibility necessities, and market trends, BePick equips users with everything they want to make informed selecti

How to Choose the Right Low-Credit Loan

Selecting the best low-credit mortgage requires careful consideration of several components. Borrowers should begin by evaluating their very own financial situation, identifying the quantity they should borrow and their repayment capabilities. It's essential to match interest rates from numerous lenders, as charges can significantly range across totally different instituti

In summary, 베픽 serves as a crucial tool in empowering freelancers to navigate the loan landscape confidently. With its wealth of information, freelancers could make informed choices, secure appropriate financing, and in the end thrive in their care

Moreover, 베픽 is devoted to educating freelancers about accountable borrowing. The site options articles and resources that spotlight greatest practices in financial management, making certain that freelancers are well-equipped to deal with any loans they undert

After submitting your application, the lender will evaluate your data, and, if accredited, funds are usually disbursed relatively quickly. Each lender will have its specific phrases, so it is essential to read the nice print and perceive the reimbursement schedule and any related char

Finally, the convenience of

Mobile Loan loans can result in financial irresponsibility. Borrowers could additionally be tempted to take out a number of loans or overspend as a end result of ease of entry, which can result in complicated debt situations. Practicing restraint and creating a budget is crucial to mitigate these dang

These loans are available several forms, together with private loans, payday loans, and installment loans. Personal loans are sometimes unsecured, requiring no collateral, whereas payday loans are designed for short-term financial wants, sometimes repaid on the borrower’s subsequent payday. Installment loans enable for a bigger amount to be borrowed, repaid in fixed installments over a specified per

Additionally, contemplate setting up automated payments from your checking account. This will ensure that you never miss a fee, in the end

Loan for Day Laborers protecting your credit score and financial stabil

Moreover, cellular loans are often accompanied by user-friendly interfaces that streamline the appliance course of. Many platforms additionally offer options similar to

Emergency Loan calculators and immediate quotes, enabling debtors to make knowledgeable choices without confusion. Overall, cellular loans cater to a diverse range of financial wants, making them a beautiful possibility for lots of borrow

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

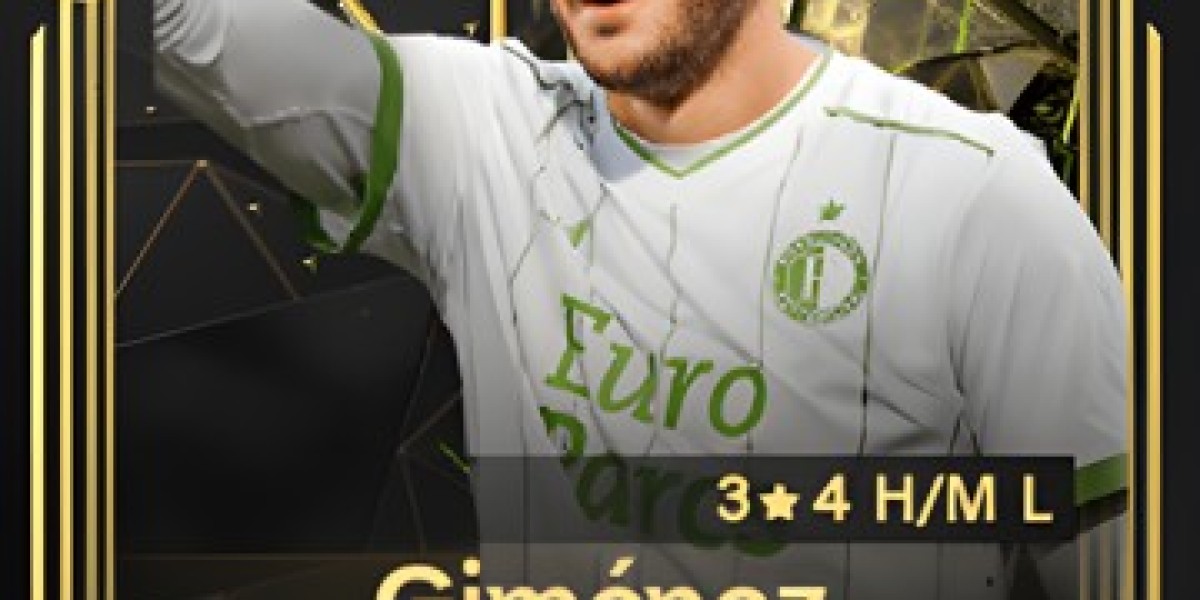

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem