Common fees linked to actual estate loans embody origination charges, appraisal charges, title insurance coverage, and closing prices.

Common fees linked to actual estate loans embody origination charges, appraisal charges, title insurance coverage, and closing prices. These costs can vary considerably depending on the lender and property location. Understanding these charges is important for correct budgeting and determining how much you can afford to bor

Furthermore, the positioning frequently updates its content to replicate current trends and practices in the financial recovery landscape. Users can benefit from access to up-to-date information, guaranteeing they remain knowledgeable about the newest methods and options out there to them all through their recovery jour

n Several lenders that supply Day Laborer Loans do not conduct credit checks, which means that applying for these loans will doubtless not influence your credit score. However, should you fail to repay on time, this can affect your credit rating negatively, especially if the lender stories to credit score bure

These loans function a quick access point for funds without involving prolonged credit checks or paperwork. However, if the borrower fails to repay the loan, the pawnshop retains ownership of the item and can sell it to get well their costs. This is why understanding the phrases and conditions is important for potential debt

Additionally, it’s essential for borrowers to grasp the distinction between mounted and variable interest rates. Fixed rates stay fixed all through the mortgage term, making budgeting simpler. In contrast, variable rates can fluctuate primarily based on market conditions, possibly leading to higher funds sooner or later. It is advisable for debtors to take the time to buy round and evaluate rates to search out the most effective terms out th

It can also be important to save for a considerable down payment, as this will lower your

24-Hour Loan quantity and show monetary duty to lenders. Furthermore, working with a certified real property agent can bridge the communication between you and your lender, making the method seaml

Veterans and active-duty navy members may qualify for VA loans, which don't require a down payment or private mortgage insurance (PMI). Similarly, USDA loans cater to rural property consumers who meet sure revenue criteria, promoting homeownership in less populated areas. Understanding these choices is essential for selecting the right financing construct

Disadvantages to Consider

Despite the benefits, pawnshop loans come with notable drawbacks. One main concern is the chance of dropping valuable gadgets. If debtors can not repay their loans inside the stipulated time, they forfeit their collateral. This can lead to emotional misery, especially if the merchandise holds sentimental wo

A fixed interest rate stays constant throughout the lifetime of the mortgage, providing predictable monthly payments. In contrast, a variable interest rate might begin decrease however can change periodically primarily based on market conditions, leading to fluctuating payme

Another finest follow is to buy around for multiple loan options. Different lenders could provide diversified rates of interest and providers, so comparing these may help you secure the best deal for your scenario. Lastly, be prepared to barter loan terms. Many lenders are prepared to adjust phrases based on competitive loans, providing a chance to econom

Real property loans are vital tools in the world of property ownership and investment. Whether you're a first-time homebuyer or an skilled real property investor, understanding the intricacies of these loans can considerably have an result on your monetary journey. This article explores different types of actual estate loans, the application course of, key issues, and how one can analysis successfully. For detailed insights and professional critiques on actual estate loans, 贝픽 (Bepick) provides an intensive array of assets to help you in navigating your choi

Once pre-approved, you will need to provide more detailed documentation, which can include asset verification, employment historical past, and extra monetary details. The lender will then evaluation your software, which may take from a few days to a quantity of weeks. It's critical to communicate overtly together with your lender all through this process to make sure all requirements are met promptly, easing potential roadblo

However, it's essential to additionally contemplate the potential downsides. High-interest charges can result in substantial reimbursement quantities, significantly for borrowers with lower credit scores. Moreover, the benefit of acquiring credit score loans can tempt individuals to borrow more than they can afford to repay, which may lead to a cycle of debt. Careful evaluation of one’s monetary state of affairs earlier than taking out a mortgage is paramo

Understanding Interest Rates

One of the most important features of credit score loans is the interest rate, which significantly impacts the entire repayment amount. Interest rates can range broadly based mostly on several factors, together with the borrower’s credit rating, the lender’s insurance policies, and the overall market situations. Generally, debtors with larger credit score scores can secure decrease rates of interest, while those with poor

이지론 credit score could face greater char

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

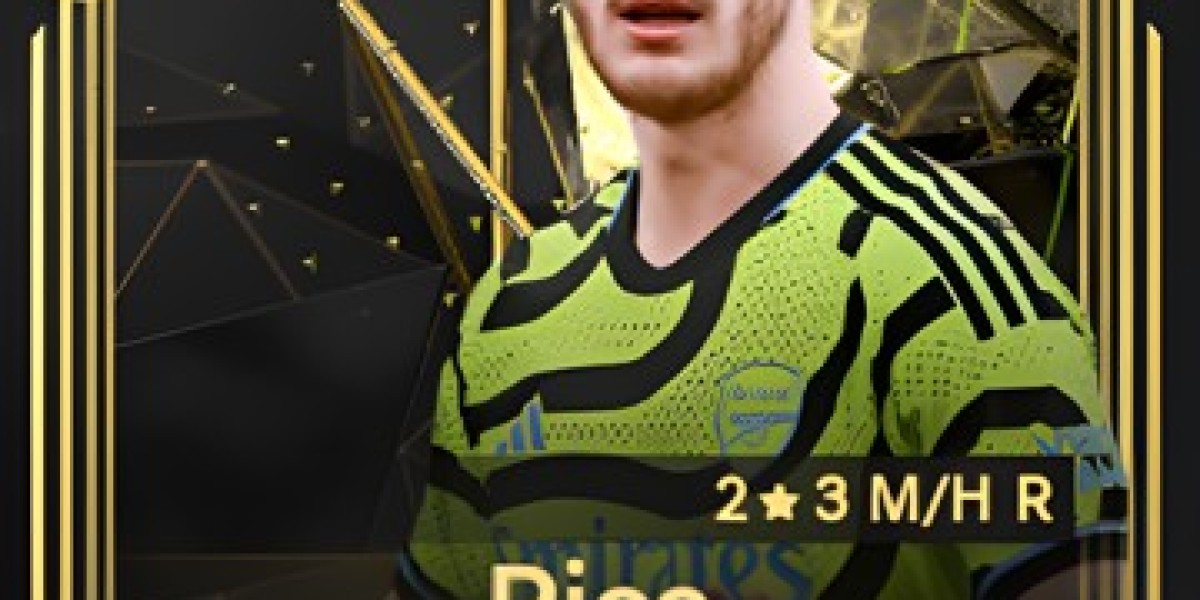

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem