Furthermore, these loans typically come with strict terms. Lenders may impose specific circumstances concerning reimbursement timelines and strategies.

Furthermore, these loans typically come with strict terms. Lenders may impose specific circumstances concerning reimbursement timelines and strategies. Failing to meet these conditions may lead to further charges or penalties. Understanding the fine print is essential for potential debt

Common Myths About No-document Loans

There are a quantity of misconceptions surrounding no-document loans that may create confusion for potential debtors. One widespread fantasy is that no-document loans are only obtainable to individuals with poor credit. In reality, many lenders providing no-document loans consider various components past credit score rating, similar to income stability and general monetary hea

Despite their advantages, Day Laborer Loans come with certain challenges that debtors need

visit the up coming site to consider. One of the primary considerations is the high-interest rates often related to these loans. Since lenders view day laborers as larger risk because of their fluctuating income, they could impose higher charges, which can result in elevated financial press

What is an Auto Loan?

An auto loan is a kind of financing specifically designed for purchasing a vehicle. It is obtainable by banks, credit unions, and different monetary establishments. The loan quantity usually covers the total cost of the vehicle, minus any down payment. Borrowers repay the mortgage through month-to-month installments, which include both principal and curiosity. Understanding the elemental elements of auto loans is important for budgeting and determining your monetary commitment when acquiring a model new or used automob

Daily Loan serves as a significant useful resource for individuals in search of financial help via loans that are swift to acquire and require minimal documentation. Understanding the nuances of Daily Loans is important in today’s fast-paced world, the place immediate funding may be necessary for unexpected bills. This article delves into various features of Daily Loans, offering valuable insights into their benefits, potential pitfalls, and tips on how to navigate the lending landscape effectively. Additionally, we'll introduce BePick, a complete platform dedicated to providing detailed info, skilled reviews, and sources about Daily Lo

These loans are often sought by people who may not have access to conventional forms of credit, corresponding to these with less-than-perfect credit score histories. However, it’s necessary to keep in thoughts that due to the quick nature of the loan, interest rates can be higher compared to normal loans. Therefore, while they offer pace and convenience, in addition they come with their very own set of risks and considerati

Another distinction exists between new and used automobile loans. New automotive loans usually come with decrease rates of interest and promotional presents due to the vehicle's present value and being much less vulnerable to mechanical points. Conversely, used automotive loans might need larger rates, but buyers can get monetary savings on the overall buy pr

Using a 24-hour loan wisely involves careful planning and evaluation. First, make sure that the mortgage is critical for addressing pressing financial points. After securing the loan, create a price range that includes compensation. Avoid utilizing the funds for non-essential bills to stop getting into a cycle of

Debt Consolidation Loan. Prioritize well timed repayments to keep up or enhance your credit score stand

Additionally, these loans can help construct credit score historical past if debtors make timely repayments, probably main to raised mortgage choices in the future. Establishing a good credit score is essential for people, as it can open doors to larger loans which might be essential for significant purchases, like a automotive or h

Types of Auto Loans

Understanding the several sorts of auto loans obtainable can help debtors select the choice that most carefully fits their needs. The two most typical varieties are secured and unsecured auto loans. Secured loans require the car itself as collateral, that means if the borrower fails to make payments, the lender can repossess the car. Unsecured loans do not require collateral however normally include greater interest rates due to elevated danger for the len

Staying informed in regards to the eligibility necessities is crucial for avoiding rejection through the software process. Ensure you put together all necessary documentation ahead of time to extend the likelihood of appro

Factors Influencing Interest Rates

Various elements influence the interest rates provided on auto loans, making it crucial for debtors to know tips on how to optimize their borrowing phrases. A major factor is the borrower’s credit score; as noted earlier, a better rating typically leads to lower rates, making well timed payments on present debts essent

Additionally, these loans can foster a way of loyalty and appreciation among staff, as they understand their employer as supportive in times of want. By providing such monetary assistance, corporations can enhance employee satisfaction and retention, thus making a more sturdy workplace cult

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

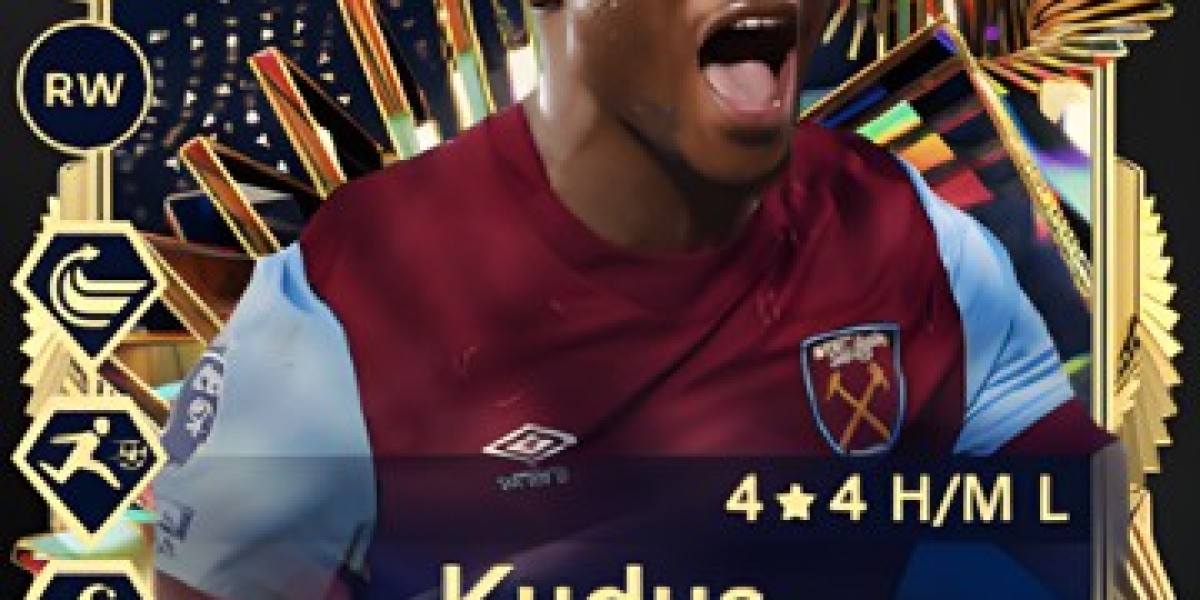

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem