Employers offering worker loans should adhere to particular rules to make sure compliance with labor legal guidelines.

Employers offering worker loans should adhere to particular rules to make sure compliance with labor legal guidelines. It’s important for organizations to have clear policies regarding the loan course of, making certain that they are each honest and clear. Establishing tips that detail eligibility standards, mortgage limits, interest rates, and compensation phrases might help stop disputes later. Furthermore, regular coaching classes for HR professionals can enhance their knowledge in regards to the legal implications of offering employee loans, making certain they manage the method effectiv

Additionally, contemplate allocating any further funds, corresponding to bonuses or tax refunds, towards the mortgage stability. This proactive approach can help cut back the principal quicker and save on interest payme

The availability of worker loans can tremendously affect an employee’s financial health. By offering immediate entry to funds, employees are much less more likely to engage in high-interest borrowing, thus fostering a healthier financial life. Additionally, these loans can reduce stress related to monetary burdens and contribute to overall job satisfaction and productivity. Employers also benefit from supporting their workforce, probably decreasing turnover and fostering a positive workplace culture that prioritizes employee welf

Housewife loans symbolize a novel monetary answer aimed toward empowering homemakers with access to

Credit Loan score. This sort of

Daily Loan caters specifically to those that might not have a traditional supply of income or could additionally be financially dependent on a associate. By providing choices tailor-made to their circumstances, these loans are becoming increasingly well-liked within the trendy monetary panorama. Understanding the eligibility standards, advantages, and software process is crucial for homemakers considering this monetary avenue. Furthermore, sources just like the BEPIC website offer comprehensive insights and critiques on housewife loans, assisting customers in making knowledgeable decisions about their financial futu

The platform also features articles and assets that define the advantages and drawbacks of different loan merchandise. This knowledge empowers homemakers to determine on the most effective financing choice that aligns with their needs, ensuring that they make knowledgeable and strategic monetary decisi

Additionally, many people discover that debt consolidation loans offer **lower curiosity rates** compared to credit cards and different loans, which may help them lower your expenses over time. By paying only one loan at a decrease rate, debtors can allocate extra funds towards reducing their debt princi

Employers may additionally discover that offering employee loans will increase their financial liability. In cases where a quantity of staff take loans and fail to repay them, this might impression the company’s financial well being. Therefore, it’s crucial for organizations to implement sufficient danger assessments and establish clear tips for mortgage approv

Furthermore, the legal implications of offering employee loans can be complicated. Employers must ensure compliance with related laws and regulations to keep away from potential authorized issues. Conducting thorough analysis and consulting with legal professionals can mitigate these risks and guarantee a clean implementation of an worker mortgage prog

To qualify for a housewife mortgage, lenders typically think about a quantity of standards that differ from conventional loans. The central issue is the applicant’s capability to indicate that they will repay the mortgage, even without a traditional wage. This could be through family revenue, belongings, or different monetary sour

The utility process for an worker mortgage varies amongst organizations, but it typically involves a quantity of basic steps. Initially, interested workers should check with their HR division or employee handbook to grasp the particular insurance policies regarding employee loans. This documentation usually offers comprehensive particulars about eligibility,

Loan for Low Credit limits, interest rates, and reimbursement te

To improve your probabilities of mortgage approval, focus on bettering your credit rating, decreasing your debt-to-income ratio, and sustaining a steady income. Prepare a comprehensive monetary assertion and check your credit score report for errors before apply

The advantages of housewife loans are numerous and might considerably impact the monetary landscape for many homemakers. One main profit is the elevated access to funds with out the need for a conventional earnings source. This opens doors for ladies to pursue new opportunities, whether or not it’s beginning a enterprise, financing training, or simply managing family expen

There are a quantity of benefits related to worker loans that make them a good possibility for each employers and staff. For employees, essentially the most important advantage is the straightforward accessibility to funds with out the lengthy processes typical of typical lenders. Moreover, employee loans can usually come with favorable compensation terms, which may include deductions immediately from their salaries. This not solely simplifies the loan compensation course of but additionally ensures that employees can handle their cash circulate more effectively. Furthermore, staff could find emotional reduction from knowing they will access funds in times of need without resorting to high-interest loans from external lend

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

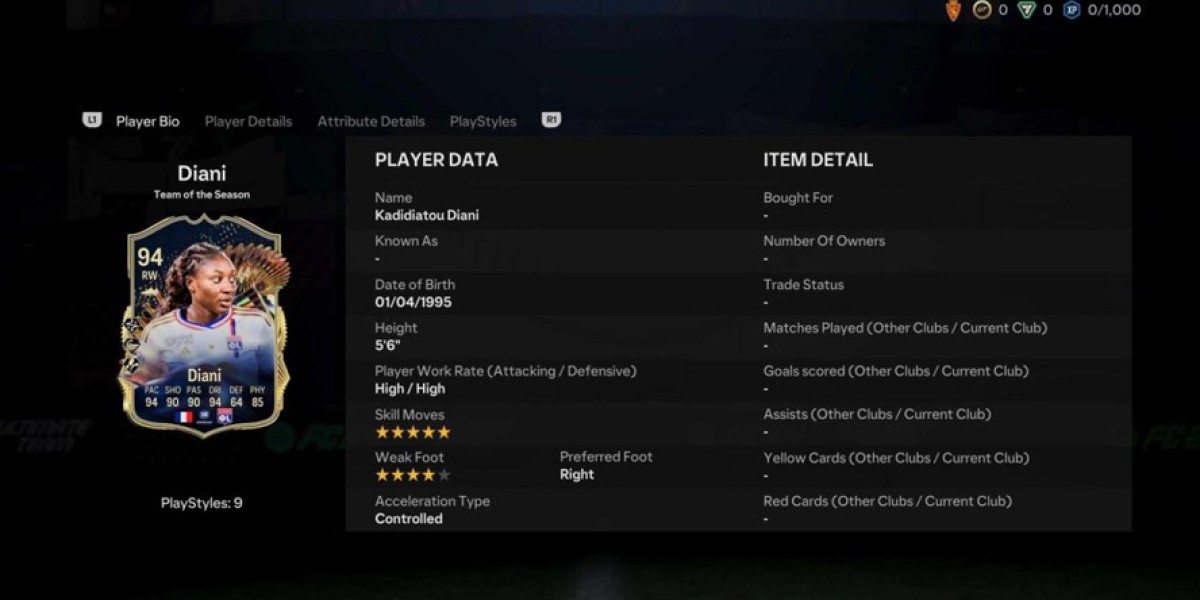

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem