What Are Additional Loans?

Additional loans, often referred to as supplementary loans, are financial products that provide borrowers with the opportunity to secure extra funds past their.

What Are Additional Loans?

Additional loans, often referred to as supplementary loans, are financial products that provide borrowers with the opportunity to secure extra funds past their preliminary borrowing limits. They are mostly sought out when people or companies face sudden bills or need further capital for projects. For instance, a home-owner might think about an extra mortgage for residence renovations or debt consolidation, whereas a enterprise may use it to capitalize on a new opportun

Moreover, potential debtors ought to assess their finances, figuring out how a lot they'll afford as a month-to-month cost. This calculation includes factoring in extra costs such as insurance, upkeep, and fuel, ensuring that the mortgage matches comfortably within their monetary landsc

However, whereas these loans present potential advantages, additionally they require responsible administration. Employers must clearly outline mortgage phrases and repayment guidelines to make sure both events understand their obligations. Effective communication about the process can decrease misunderstandings and create a easy lending experie

Yes, obtaining pre-approval for an auto loan can help you perceive your borrowing capacity and negotiate higher phrases. Pre-approval provides a clearer image of the rate of interest and mortgage quantity you qualify for, making it easier to set your automotive budget accordin

Benefits of Using Bepec for Credit Loan Information

For anybody navigating the complexities of credit loans, Bepec stands out as a useful resource. The web site presents a wealth of details about numerous forms of loans, including critiques of various lenders and detailed descriptions of loan choices available out there. This can assist customers in making knowledgeable choi

Investing in house enchancment tasks that enhance the property's worth is one other strategic use of additional loans. Such investments can result in the next resale value, creating long-term financial featu

Finally, always learn the nice print earlier than signing any settlement. Understanding compensation terms, interest rates, and potential penalties ensures that borrowers are totally ready for their new monetary dedicat

Risks Involved with Unemployed Loans

Despite their benefits, it’s crucial to acknowledge the potential risks associated with unemployed loans. One of essentially the most important drawbacks is the customarily higher rates of interest in comparison with conventional loans. These charges can result in increased monetary pressure if the loans usually are not managed accurately. Borrowers should assess their capability to repay these loans before committing to avoid falling deeper into d

Bepec also offers expert insights into the mortgage software course of, together with recommendations on bettering credit score scores and maximizing approval possibilities. Users can

Find Out More useful articles that break down technical jargon, making the world of credit loans more accessible to all. Furthermore, the site features user testimonials and scores, permitting potential borrowers to gauge lender reliabil

BePick stands out for its user-friendly interface, making it easy to navigate through varied topics related to employee loans. Whether you’re an worker looking for assist or an employer considering implementing a loan program, BePick presents valuable perspectives and resources to information your decision-making course

Additionally, it’s essential to learn the fantastic print of each provide, as there may be extra fees involved that would influence the overall value of the mortgage. Hidden charges can range from processing charges to penalties for early repayments, so thorough diligence is essent

Additional loans can play an important position in personal and

Business Loan financial administration, offering flexibility when unexpected expenses come up. However, understanding the nuances of those loans is essential for making knowledgeable selections. This article delves into what extra loans are, how they work, the types available, and suggestions for effectively managing them. Furthermore, we will highlight the distinctive resources available on the BePick website, which presents detailed data and critiques on further lo

In addition to decrease interest rates, employee loans sometimes offer flexible repayment choices. For occasion, employers can tailor compensation plans to fit their employees' monetary situations, which could be significantly useful for those experiencing temporary hardships. This flexibility helps employees feel secure, understanding they've options available to t

Additionally, BePick is devoted to offering honest reviews that commemorate the transparency of lenders and assist customers perceive potential pitfalls. By frequently updating their content, BePick displays the most present developments and rules within the lending mar

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

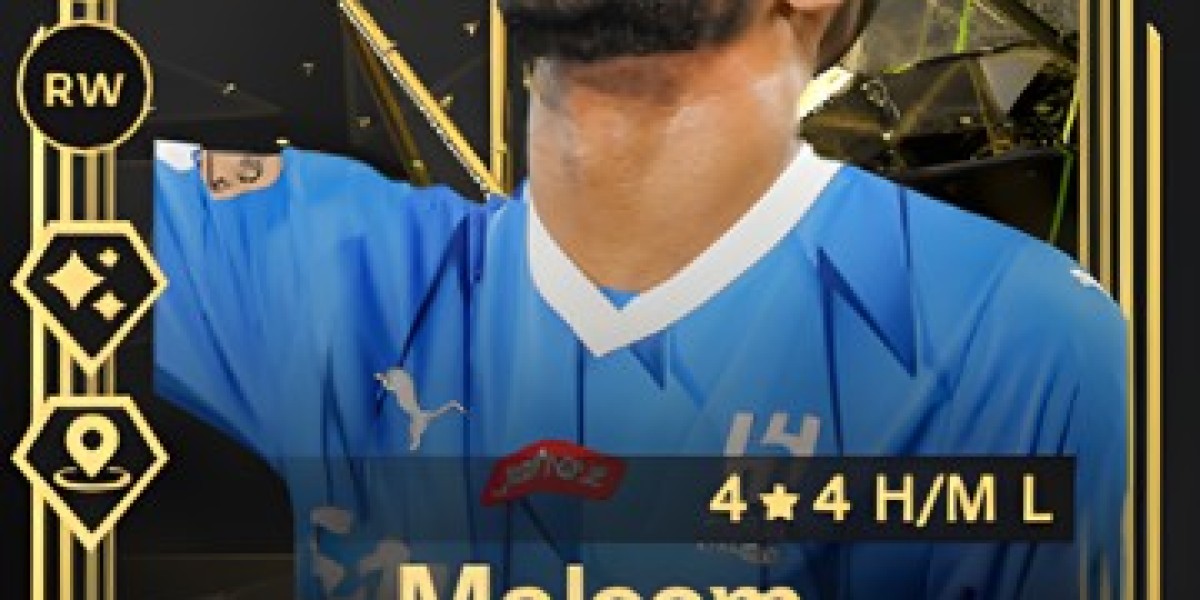

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem