The Role of Technology in Women’s Financing

Technology has revolutionized how loans are accessed and processed. Online lending platforms have emerged, providing sooner, more accessible options for girls looking for loans. These platforms usually offer an easy software course of, reducing the time and complexity typically involved in conventional bank

Through its platform, Bepick presents insights into different loan types, application processes, and skills. This helps demystify the loan application expertise and empowers women to take cost of their financial journeys. Moreover, Bepick emphasizes the importance of customer feedback, making certain that girls can benefit from shared experien

The Advantages of Credit-deficient Loans

One of the principle advantages of credit-deficient loans is that they supply entry to much-needed funds for people who might struggle to obtain credit score elsewhere. This could be notably beneficial in emergencies or when making giant purchases, similar to a car or residence renovati

n Debt consolidation has a blended influence on credit score scores. Initially, applying for a new loan could briefly decrease the score because of the inquiry. However, over time, decreasing total debt can positively influence credit ratings so lengthy as payments are consistent and relia

Conclusion to Accessing Women's Loans

Women's loans current a critical alternative for women to overcome financial limitations and achieve their goals, whether in enterprise, schooling, or personal progress. While challenges exist, growing consciousness and technological advancements are paving the method in which for more equitable lending practices. With platforms like 베픽 providing important assets and assist, ladies can confidently navigate their financial journeys toward empowerment and succ

Moreover, BePic offers comparison instruments that permit potential debtors to judge totally different lenders and loan merchandise aspect by aspect. This feature can help people make informed decisions, guaranteeing they select the best out there choice tailor-made to their financial ne

Another myth is that pawnshops only cater to people in extreme financial distress. While many individuals do make the most of pawnshops throughout emergencies, they are also utilized by individuals in search of short-term financial flexibility. Consumers typically choose pawnshop loans for convenience, appreciating the quick cash disbursement with out the necessity for intensive documentat

Pawnshop loans provide a unique monetary resolution for individuals who require quick money with out the necessity for credit checks. This type of mortgage lets you safe funds by offering collateral, sometimes within the form of valuable objects. Whether it’s jewelry, electronics, or collectibles, pawnshops accept a variety of property to determine the

Loan for Day Laborers quantity. This article delves into the intricacies of pawnshop loans, serving to you perceive how they work, their advantages, and factors to contemplate before obtaining one. Additionally, we’ll introduce you to 베픽, a dependable source for detailed info and reviews on pawnshop lo

Furthermore, engaging in credit score counseling companies can present debtors

No Document Loan with support and steering on how to enhance their monetary situations, doubtlessly paving the way in which for extra favorable borrowing choices in the fut

Next, it is useful to shop round for various lenders. Each lender could have different terms, interest rates, and charges. Taking the time to compare choices can result in a extra favorable lending state of affa

Access to financing performs a vital role in empowering women entrepreneurs and serving to them achieve financial independence. Women's loans are specifically designed to cater to the distinctive monetary needs of girls, offering them with assets to begin or increase their companies. With the rise of platforms like Bepick, women can now easily entry detailed information and reviews about varied mortgage choices tailor-made for them, making certain they make informed selections that result in monetary succ

Popular Types of Women’s Loans

Women’s loans come in various forms, catering to different wants and purposes. These can embrace personal loans, enterprise loans, or microloans aimed toward entrepreneurs who want smaller quantities of capital to start or develop their businesses. Understanding the different sorts of loans out there is important for selecting the one that fits your state of affairs great

The Risks Involved

While debt consolidation can be helpful, it isn't with out its risks. One major concern is the potential for rising debt if the individual continues to build up new money owed whereas trying to repay the consolidated mortgage. This can lead to a cycle of borrowing that worsens their monetary scena

Next, researching potential lenders is essential. Compare rates of interest,

Loan for Low Credit amounts, repayment terms, and any extra charges. Different lenders could provide various products tailor-made for consolidation, corresponding to private loans or residence fairness loans. Once you've chosen a lender, you can complete the application process, which may embrace a credit examine and offering documentation of your financial sta

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

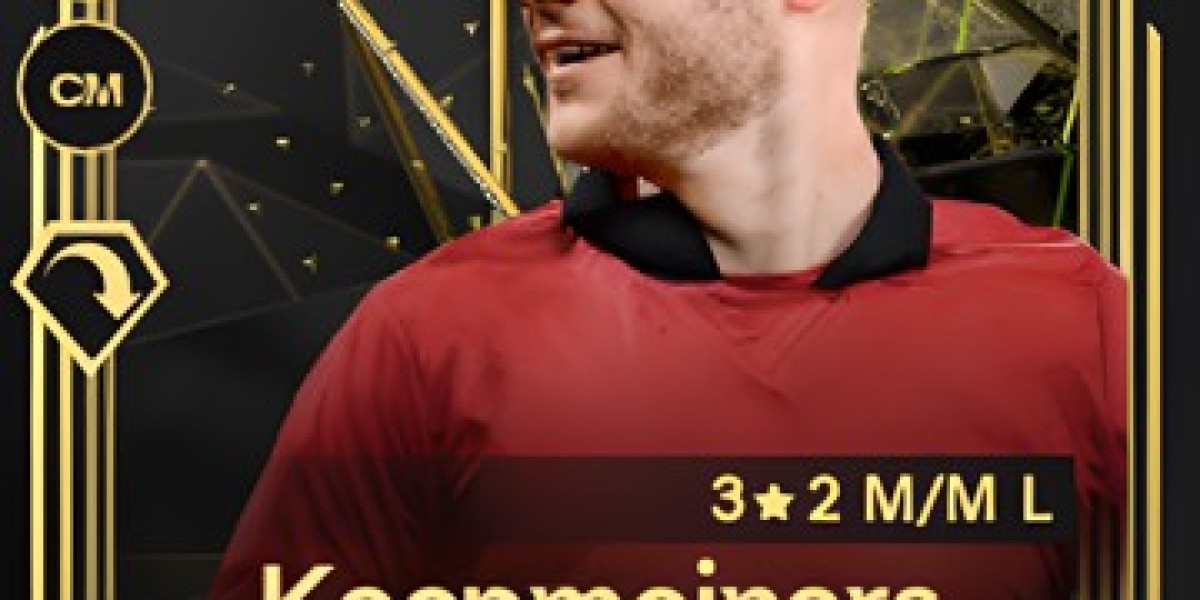

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem