Managing Your Personal Loan Effectively

Once you secure a private mortgage, managing it responsibly is important to sustaining your monetary health.

Managing Your Personal Loan Effectively

Once you secure a private mortgage, managing it responsibly is important to sustaining your monetary health. Set up computerized payments to avoid missed deadlines, which may incur late fees and negatively affect your credit rat

Understanding the Application Process

The software process for same-day loans is usually structured to be fast and easy. Most lenders present on-line platforms the place potential debtors can fill out their information and submit essential documentation. Key particulars sometimes include private data, revenue data, and banking particul

BePick: Your Go-To Resource for Real Estate Loans

BePick is a useful platform devoted

redirect to hoxyy.com offering complete data on real property loans. Whether you are in search of detailed critiques of assorted loan options, comparisons between lenders, or insights into current market trends, BePick serves as a one-stop resource. It presents user-friendly tools and calculators to assist you estimate your borrowing capacity and monthly payments precisely. The website is designed to empower borrowers by simplifying the mortgage process and making certain that you've all the necessary data at your fingertips. With BePick, you can confidently navigate your real estate financing jour

Common Misconceptions

There are many misconceptions surrounding actual property loans that can lead to confusion. A prevalent myth is that you simply need a 20% down payment to safe a mortgage. While a 20% down payment might assist you to keep away from personal mortgage insurance coverage (PMI), numerous loan programs, together with FHA and VA loans, require much decrease down funds. Another widespread belief is that each one lenders have the same terms. In reality, rates of interest, fees, and

Daily Loan merchandise can vary considerably throughout totally different institutions, highlighting the significance of purchasing around for the best d

Moreover, prospective debtors should be sure that the lender is clear about fees and charges. Hidden costs can considerably increase the whole quantity owed, making it essential to inquire about all possible bills early within the course

Benefits of Real Estate Loans

A key benefit of

Real Estate Loan estate loans is the ability to leverage your funding. With a comparatively small down fee, you can purchase property price far more than your preliminary funding. This leverage can lead to significant returns if property values recognize over time. Additionally, mortgage interest funds can often be tax-deductible, which reinforces the monetary benefits of proudly owning property. Beyond monetary advantages, proudly owning actual property additionally supplies personal stability and a way of group, making it a vital a half of many individuals’ financial portfol

How to Qualify for a Low-Credit Loan

Securing a low-credit loan usually entails several key steps. First, potential debtors ought to thoroughly assess their credit score state of affairs. Understanding the precise credit rating, present debts, and financial obligations is crucial earlier than making use of for a mortgage. This evaluation will inform them of how much they might moderately expect to bor

The interest rates for housewife loans can differ based on the lender and the borrower's credit profile. Typically, rates vary from 5% to 15%. It's advisable to check offers from various lenders to search out the most favorable terms that fit your financial scena

Next, you must consider your revenue and bills. Understanding your price range will help decide your ability to make month-to-month funds comfortably. Accurately calculating how much of your income you'll be able to allocate to loan repayments is critical to keep away from defa

After submitting your application, the lender will assess your creditworthiness and, if approved, determine your loan amount and terms. Once you settle for the supply, the lender will disburse the funds to your checking acco

Tips for Applying for Housewife Loans

When making use of for a housewife mortgage, preparation is essential. It is essential to gather all needed documentation that will help your loan application, even when traditional revenue proof isn't required. Submitting a thoughtful budget showing how the mortgage might be utilized can considerably improve your probabilities of approval. Additionally, researching a number of lenders can expose you to the best charges and phrases out there out there. Don’t hesitate to ask questions or seek readability on terms to keep away from future financial surpri

Real property loans are monetary devices that allow individuals and companies to acquire properties by borrowing funds from lenders. The landscape of real property financing is complex, and understanding the assorted choices, phrases, and situations is crucial whether or not you're a first-time homebuyer or a seasoned investor. This article will explore the basics of actual estate loans, focusing on various sorts, advantages, and what to contemplate before borrowing. Furthermore, we are going to introduce BePick, a complete platform that gives detailed insights, evaluations, and resources that can help you navigate the world of real estate loans more effectiv

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

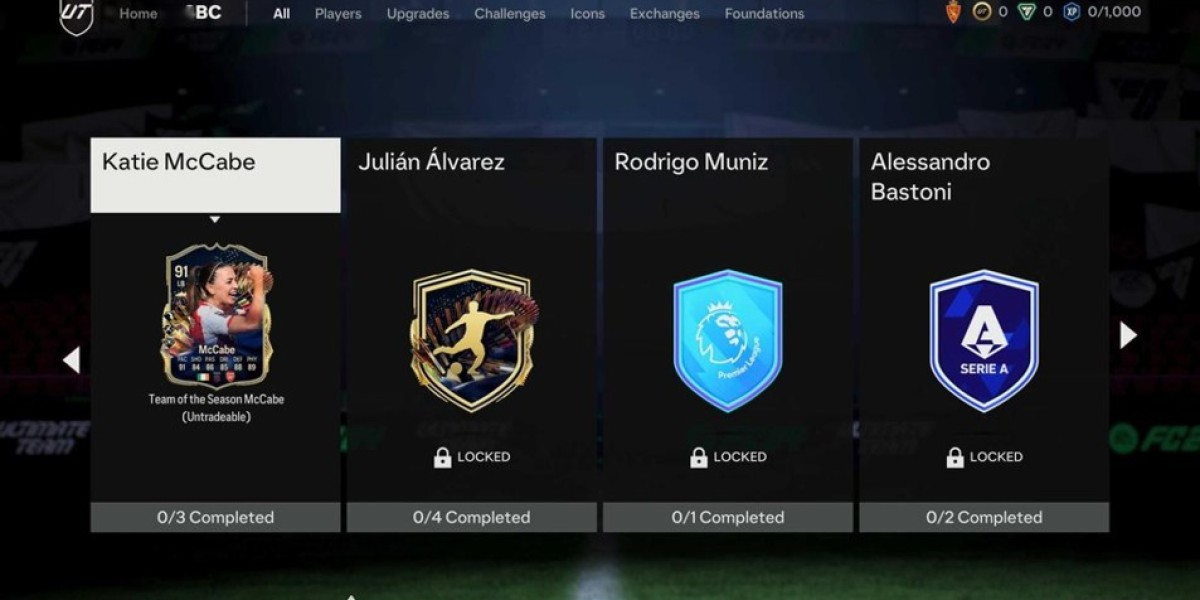

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem