Types of Mobile Loans

Mobile loans are available various types to meet various financial wants. Among the most common types are personal loans, payday loans, and installment loans.

Types of Mobile Loans

Mobile loans are available various types to meet various financial wants. Among the most common types are personal loans, payday loans, and installment loans. Personal loans provide a versatile borrowing amount and are often appropriate for bigger expenses such as residence renovations or debt consolidation. Payday loans, however, are short-term loans designed to cover quick expenses until the subsequent payday, however they often come with greater rates of inter

Moreover, Be픽 contains a user-friendly interface that permits potential debtors to navigate easily between comparisons and guides. By using the assets available on Be픽, individuals can considerably improve their understanding of low-credit loans and make better financial choi

Impact on Your Credit Score

Using a debt consolidation mortgage can have an result on your credit score in varied methods. Initially, making use of for a loan leads to a tough inquiry in your credit report, which could marginally lower your rating. However, as you make on-time payments, your score can enhance considera

BePick: Your Resource for 24-hour Loans

When navigating the world of 24-hour loans, having a reliable resource can considerably ease the decision-making process. BePick serves as a complete platform devoted to providing in depth particulars and critiques specific to 24-hour loans. From in-depth analyses of assorted mortgage products to consumer experiences, BePick equips borrowers with the critical info needed for knowledgeable selecti

Disadvantages of Low-Credit Loans

Despite their advantages, low-credit loans include important drawbacks. As previously talked about, these loans typically carry larger interest rates, which may result in substantial reimbursement amounts over time. If not managed properly, borrowers threat falling right into a cycle of debt because of the exorbitant prices associated with these lo

Risks Associated with Low-Credit Loans

Despite the aforementioned benefits, low-credit loans come with inherent risks. One vital concern is the tendency towards high-interest rates, which might create substantial debt if not managed correctly. Borrowers need to calculate the total value of the loan and assess their capacity to repay without jeopardizing their funds. Understanding the implications of excessive APRs (Annual Percentage Rates) is essential before coming into a mortgage agreem

Additionally, low-credit loans can function a stepping stone for people trying to improve their credit scores. By making timely payments, debtors can steadily enhance their credit ratings, opening up alternatives for higher loan terms in the fut

Eligibility Criteria for Low-Credit Loans

Lenders providing low-credit loans usually have a more lenient set of eligibility standards, which might embrace concerns past credit scores. Factors corresponding to employment status, income stage, and existing debt obligations play a significant role in figuring out mortgage eligibil

Lastly, should financial difficulties arise, it is advisable for debtors to communicate with their lenders proactively. Many lenders supply hardship applications or different preparations to help debtors navigate robust ti

In right now's fast-paced world, monetary emergencies can arise unexpectedly. Whether it is a medical invoice, automotive restore, or pressing residence expense, having quick and reliable access to funds is essential. This is where 24-hour

Other Loans come into play, providing individuals with the ability to safe short-term financing effectively. In this text, we are going to delve into the concept of 24-hour loans, exploring how they work, their advantages, the potential disadvantages, and what debtors ought to contemplate when looking for these loans. We may also introduce BePick, a comprehensive platform that gives detailed data and evaluations on 24-hour loans, empowering debtors to make knowledgeable selecti

How to Choose a Reliable Lender

Choosing a reliable lender is essential when in search of a 24-hour loan. Not all lenders function on the same rules, so it's essential to do thorough analysis. Start by checking reviews and ratings from different borrowers. Platforms like BePick provide comprehensive insights and evaluations that may assist in figuring out reliable lend

How to Choose the Right Low-Credit

Loan for Credit Card Holders Selecting the best low-credit loan requires thorough analysis and cautious consideration. Start by evaluating interest rates throughout numerous lenders, because the differences can considerably affect total repayment quantit

The Role of Online Information Platforms like 베픽

Online information platforms like 베픽 have become invaluable sources for borrowers exploring low-credit mortgage options. By providing detailed data, comparisons, and consumer reviews, these platforms assist customers navigate the plethora of lending options obtaina

Canadian pharmaceuticals online shipping

Canadian pharmaceuticals online shipping

Website Description for Document Catalog

By tilerolaf

Website Description for Document Catalog

By tilerolaf Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Tutorial: Step-by-Step Instructions to Cultivate Potatoes in a Container Inside

Join Our Community: Share and Discover Valuable Documents

By maratikc8

Join Our Community: Share and Discover Valuable Documents

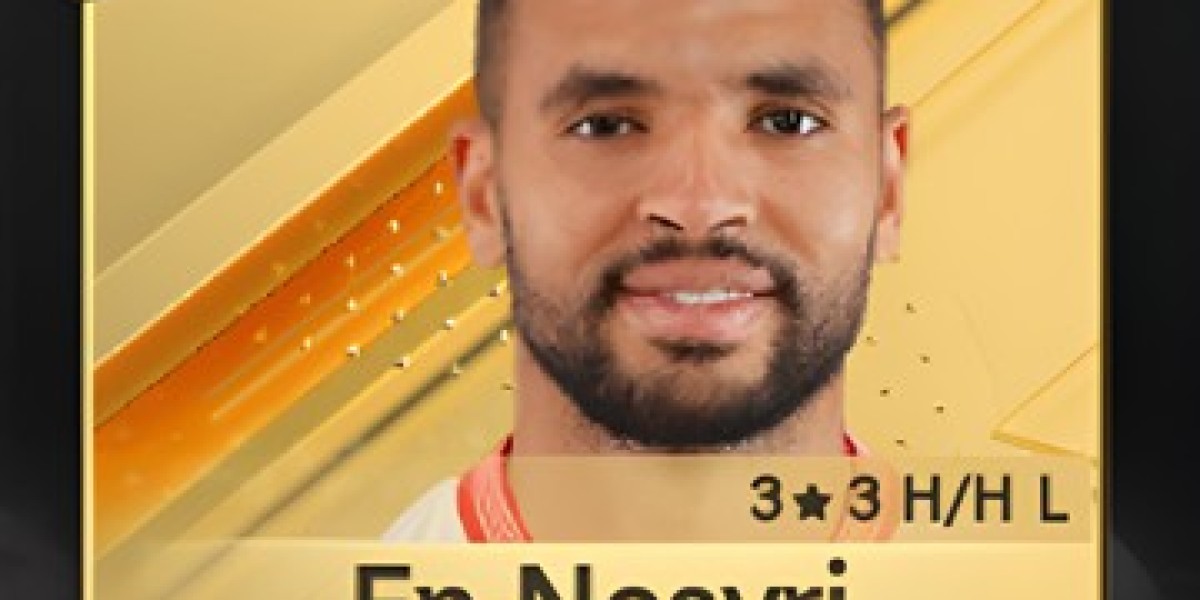

By maratikc8 Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem

Master the Game: Unlocking Artem Dovbyk's TOTS CHAMPIONS Card in FC 24

By xtameem